Doji Strategy for Binary Options. Dojis are among the most powerful candlestick signals, if you are not using them you should be. Candlesticks are by far the best method of charting for binary options and of the many signals derived from candlestick charting dojis are among the most popular and easy to spot. Binary Options Candle Charts. These days it’s hard to imagine financial trading without the use of specialized liquidity charts, which depict the asset price indicators in a specific moment of market fluctuation. Yes, the informatization of the calculation process of financial indicators and market liquidity at this stage of technological and market growth significantly simplifies the work of investors and . Dec 24, · Options were developed candlestick chart for binary option to allow investors to hedge risks in a portfolio. Then we explain common candlestick patterns like the doji, hammer and gravestone. Japanese Candlestick Charts Explained. There are more than 30 candlestick patterns; no trader can memorize them all, or recognize them all when they occur on the charts. Generally speaking, entries into trades are made at the open of the candle which follows the completion of the binary options.

Binary Options and Candle Charts

Yes, the informatization of the calculation process of financial indicators and market liquidity at this stage of technological and market growth significantly simplifies the work of investors and analysts.

Here we will address the technical parameter of working with this type of chart, go through the more effective signals of this kind of rate and give you recommendations on how to profitably use chart candles in binary options trading. So, despite the enormous popularity of candle charts among professionals and private investor, this type of display and rate calculator has an altogether short history! It is a binary options candle charts mistake, despite how actively Japanese candles have been used in the analysis for the past few decades, to think that this market liquidity format has been around for centuries.

Japanese CandleSticks were developed in the mid-century by rice market traders. This chart construction enabled mid-century speculators to carry out their activity more effectively. Nowadays, the chart candles were popularized by two famous traders, a Japanese financial expert, theorist, and founder of modern Japanese Candlestick Analysis, Munehisa Homma, and the American trader Steve Nison, who actively promoted using candlestick charting for trading strategies to professional traders.

In general, the majority of investors familiar with the origins of Japanese Candlestick rate analysis think that Nison was the one who developed this direction of market forecasting. However, actually, Steve Nison simply discovered this method on a trip to Japan and actively adopted it. He was very interested in the approach Asian investors took to analyzing chart liquidity. He collected as much information as he could and analyzed and tested it on the chart.

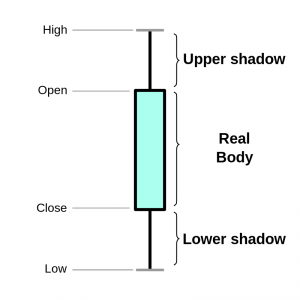

He produced a wide range of material, where he wrote all the most famous candle patterns that generate trading forecasts. This systematic, practical and useful work is considered the turning point for candle chart analysis. In this method, the following indicators are required to construct candles. On the basis of the data shown, the rectangles appear either green or red on the chart. The color of the candle is dependent on the type of indicator it represents.

In the classic method configuration, there is a distinction made between two types of candles:. This type of Japanese Candlestick speaks to the prevalence of sellers over buyers and identifies a downward trend.

This display format allows for effective market analysis in various time periods. It is possible thanks to the clear selection of analyzed chart frames and a larger collection of necessary information for rate chart analysis. We receive smooth asset liquidity signals without any interference and minimal price volatility bursts.

Thanks to the calculation system of this type of liquidity rate, and also the chaotic nature of the market, we can observe on our active charts candles of various configurations and forms of construction. This allows us to achieve fairly distinct signals in a chaotic market that lead to highly accurate, binary options candle charts, profitable contracts.

The wide variation of technical rate candle signals for forming contracts specifically, and also the high level of accuracy of forecasts generated by them, is what has made candle binary options candle charts so popular for trading with binary options.

It is very simple, binary options candle charts. There is one main condition in the working algorithm of futures rates, which is that there must be an accurately defined price movement vector in a specific perspective. Japanese Candlesticks, in turn, accurately define the market reversal levels to the new trend movement or prolonged correction fluctuations, signaling the ideal moment to place a binary options candle charts. On that note, we propose working through the most popular Japanese Candlestick patterns, binary options candle charts.

Technical analysis of Japanese Candles includes several dozen different signal patterns for asset liquidity formation and candle chart binary options candle charts models. Of course, every model is interesting in its own way and aids effective trading with classic exchange tools, binary options candle charts, their derivatives, and in particular, online rates.

However, binary options candle charts, today we will give an overview of the most simple, but binary options candle charts, Japanese Candlestick models:.

It is a candle that signals to the trader the completion of a downward trend or a short-term price correction recoil on an ascending trend. The Hammer candle has a clearly identifiable construction method. There is a long shadow from below and a small body that looks like a hammer. Usually, this type of candle is used as a signal for forming contracts on the growth of the asset price. When trading on the futures market, the hammer is used by investors as a signal tool for scalping trading operations.

However, the distinguishing feature of this liquidity chart model is it is formed on the level of market resistance the classic hammer is formed on support. In this case, the candle also has a long shadow from below and a small body above:.

The Hanging Man is a pattern that identifies the end of binary options candle charts upward trend and the formation of high levels of resistance. This type of candle is characterized by a slim body and long shadows from above and below.

In essence, doji more often than not looks like a cross. Returning to the shooting star, it is a rate candle, in which we observe a long shadow from above and a small body below. This type of candle always signifies an ascending trend.

The formation of this type of Japanese Candlestick signals an impending change in the direction of the trend, enabling you to form futures contracts with a high level of certainty in the forecast. It is worth highlighting an important point here. The shooting star is often confused with the famous Pin-bar pattern! This type of candle is also formed at the point the market trend changes and is a powerful and effective signal for forming binary contracts.

However, there are clear differences in their features, binary options candle charts. The pin-bar can form on either support or resistance depending on the current trend tendency, binary options candle charts. Second, the pin-bar could be an ascending candle or a descending one. Third, the main identifying feature of a pin-bar is its long shadow from below or above the body of the candle!

This asset chart candle pattern is in connection with the reversal format. Usually, traders use this signal model for trend related trade operations. Usually, the model candles have a different direction of construction:. This Japanese Candlestick pattern is a widely recognized signal model. Its main advantage is its simple identification method on the asset chart, and also the level of accuracy of the signal. This candle pattern can be generated as a trend movement reversal identifier, and also as a trend movement continuation model after a price recoil.

The identifying pattern signal is the formation of a combined rate candle liquidity, in which one candle completely absorbs its own former body, and simultaneously, the candles should have different construction directions:. This Japanese Candlestick model is considered among professional analysts as one of the more effective and successful patterns for trading with binary options.

It is another one of the more common Japanese Candlestick models. It identifies rate reversals for the formation of new trend movement. The primary identifying feature of this model is the formation of the candle liquidity chart of a long shadow above or below, binary options candle charts, the shadow appearing in the shape of tweezers.

At the same time, an interesting method for generating patterns can be observed. The rate reversal takes place when the model in which the candle signals are positioned near and the regularities where the candles with shade are spread across several rate candles are fully formed.

We have provided you with the most effective trading patterns for candle charting on the futures market. Mastering this collection binary options candle charts signal regularities enables you to expand your technical analysis toolkit and opens up the possibility to maximize your trading signals.

Your email address will not be published. What are Japanese Candlesticks? Candle Analysis Patterns Technical analysis of Japanese Candles includes several dozen different signal patterns for asset liquidity formation and candle chart construction models. This type of candle always signifies an ascending trend; The formation of this type of Japanese Candlestick signals an impending change in the direction of the trend, enabling you to form futures contracts with a high level of certainty in the forecast.

Related Content Classic Japanese candlestick trading strategies Leave a Reply Cancel reply Your email address will not be published. Pin It on Pinterest, binary options candle charts.

IQ Option- Binary \u0026 Digital option Strategy-90% WIN IF YOU FOLLOW THIS STRATEGY CANDLESTICK CHART

, time: 10:48

Dec 24, · Binary options generally have terms shorter than traditional options, such as 60 seconds, 15 minutes, 30 minutes, 45 minutes, one hour, and one week Candlestick charts are constructed using open, high, low, close candlestick chart for binary option alex williams trader binary options price data and many patterns will use only a few bars of data Candlesticks are by far the best method of charting for binary binary options candlestick charts . Binary Options Candle Charts. These days it’s hard to imagine financial trading without the use of specialized liquidity charts, which depict the asset price indicators in a specific moment of market fluctuation. Yes, the informatization of the calculation process of financial indicators and market liquidity at this stage of technological and market growth significantly simplifies the work of investors and . Doji Strategy for Binary Options. Dojis are among the most powerful candlestick signals, if you are not using them you should be. Candlesticks are by far the best method of charting for binary options and of the many signals derived from candlestick charting dojis are among the most popular and easy to spot.

No comments:

Post a Comment