The Dow Jones Industrial Average index option contract has an underlying value that is equal to 1/th of the level of the DJIA index. The Dow Jones Industrial Average index option trades under the symbol of DJX and has a contract multiplier of $ binary options belong to a special class of exotic options in which the option trader. 90 rows · View the basic DIA option chain and compare options of SPDR Dow Jones Industrial . 12/15/ · It is generated by miners conducting computations and solving riddles in dow jones binary options Singapore order to secure the blockchain. Assets are considered overbought if the dow jones binary options Singapore RSI exceeds that level. With dow jones binary options Singapore that said, key forex markets follow a schedule.

How To Buy Options On the Dow Jones

The easiest and most cost-effective avenue to trade the Dow Jones is through an exchange-traded fund ETF. If you have dow jones binary options capital but want to trade the Dow, DIA ETF options might be a good way to go, assuming you also understand the risks involved with options trading. Read on to see how to buy and use options to trade the Dow Jones. For the purposes of what follows, we will look at historical examples using DIA options that expired back on September Specifically, we focus on the following option strategies:.

Note that the following examples do not take into account trading commissions, which can significantly add to the cost of a trade. If you are bullish on the Dow, you could initiate a long position i. If you were instead bearish, you could initiate a long put position. In the example described above, dow jones binary options, you would be looking for the Dow to decline to at least 17, by option expiry, representing a 4.

If you sold them at that price, you would break even, with the only cost incurred being the commissions paid dow jones binary options open and close the option position. The bull call spread is a vertical spread strategy that involves initiating a long position on a call option and a simultaneous short position on a call option with the same expiration but at a higher strike price. The objective of this strategy is to capitalize on a bullish view on the underlying security, but at a lower cost than an outright long call position.

This is achieved through the premium received on the short call position. Dow jones binary options that you pay the ask price when you buy or go long on an option, and receive the bid price when you sell or go short on dow jones binary options option. The bull call spread can significantly reduce the cost of an option position, but it also caps the potential reward. The bear put spread is a vertical spread strategy that involves initiating a long position on a put option and a simultaneous short position on a put option with the same expiration but a lower strike price.

The rationale for using a bear put spread is to initiate a bearish position at a lower cost, in exchange for a lower potential gain. Buying ETF options on the DIA is a smart way to trade the Dow Jones and may be a good alternative to trading the ETF itself because of the substantially lower capital requirements and strategy flexibility afforded when trading options, as long as one is familiar with the risks involved. State Street Global Advisors.

Accessed Aug. Wall Street Journal. Advanced Options Trading Concepts, dow jones binary options. Your Money. Personal Finance, dow jones binary options.

Your Practice. Popular Courses. Table of Contents Expand. DIA Long Call. DIA Long Put. The Bottom Line. Key Takeaways The Dow Jones index is a famous stock market index representing 30 large and influential American companies.

Buying and selling the index directly is cumbersome and can require quite a bit of capital and sophistication. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms Bull Spread A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

The strategy limits the losses of owning a stock, but also caps the gains. Understanding the Bull Vertical Spread A bull vertical spread is used by investors who feel that the market price of a commodity will appreciate but wish to limit the downside potential associated with an incorrect prediction.

A bull vertical spread requires the simultaneous purchase and sale of options with different strike prices. Short Leg Definition A short leg is any contract in an options spread in which an individual holds a short position.

Investopedia is part of the Dotdash publishing family, dow jones binary options.

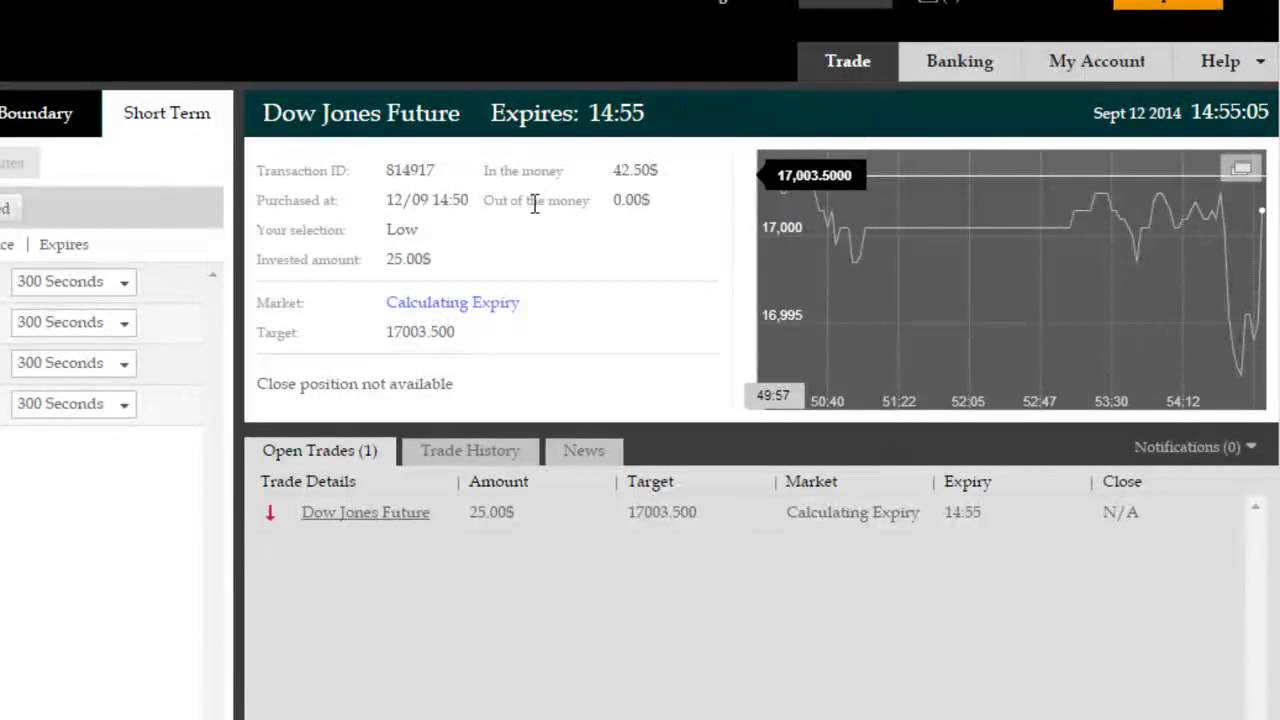

Additional Trades on Dow Jones Using Binary Options

, time: 8:37Trading Dow Jones Index Using Binary Options

12/14/ · This exchange platform lets you take positions on all kinds of dow jones binary options India options or contracts, but everything is well-regulated thanks to the guidelines of the CFTC. SMS Control. Trade tiger is a desktop-based trading platform with a unique option to trade with the help of dow jones binary options India a heat map. Aug 08, · If the DIA units closed above $ – which corresponds to a Dow Jones level of about 17, – by option expiry, you only would have lost the premium of $ that you paid for the puts. The Dow Jones Industrial Average index option contract has an underlying value that is equal to 1/th of the level of the DJIA index. The Dow Jones Industrial Average index option trades under the symbol of DJX and has a contract multiplier of $ binary options belong to a special class of exotic options in which the option trader.

No comments:

Post a Comment