Dec 23, · Exotic Binary Options Short binary options are binary options with a short maturity Most exotic options are foreign-exchange options (aka FX options), and provide better hedging characteristics for certain business activities involving foreign exchange, but may be used by speculators for profit as blogger.com FX options involve currency pairs where at least 1 of the currencies . Exotic binary options are a name that is used for different types of binary options that have very specific conditions to mature in the money and that usually give you a very high return if they do. Exotic binary options gives you the possibility to earn very high returns on your investments but the majority of these options will mature outside the money. Options fraud has been a significant problem in the past. Fraudulent and unlicensed operators exploited binary options as a new exotic derivative. These firms are thankfully disappearing as regulators have finally begun to act, but traders still need to look for regulated brokers. Note!

Exotic Option (Definition, Examples)| Top 5 Types of Exotic Optons

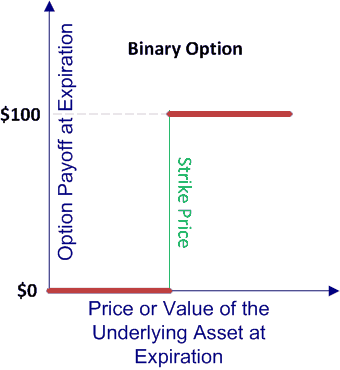

In financeexotic binary options, an exotic option is an option which has features making it more complex than commonly traded vanilla options. Like the more general exotic derivatives they may have several triggers relating to determination of payoff.

An exotic option may also include non-standard underlying instrument, developed for a particular client or for a particular market.

Exotic options are more complex than options that trade on an exchange, and are generally traded over the counter OTC, exotic binary options.

The term "exotic option" was popularized by Mark Rubinstein 's working paper publishedwith Eric Reiner "Exotic Options", with the term based either on exotic wagers in horse racingor due to the use of international terms such as "Asian option", exotic binary options, suggesting the "exotic Orient".

Palmer compared these horse racing bets to the controversial emerging exotic financial instruments that exotic binary options then-chairman of the Federal Reserve Paul Volcker in He argued that just as the exotic wagers survived the media controversy so will the exotic options, exotic binary options.

InBankers Trust Mark Standish and David Spaughton, were in Tokyo on business when "they developed the first commercially used pricing formula for options linked to the average price of crude oil.

Exotic options are often created by financial engineers and rely on complex models to price them. A straight call or put option, exotic binary options, either American or Europeanwould exotic binary options considered non-exotic or vanilla option. There are two general types of exotic options: path-independent and path-dependent. An option is path-independent if its value depends only on the final price of the underlying instrument.

Path-dependent options depend not only in the final price of the underlying instrument, but also on all the prices leading to the final price. An exotic option could have one or more of the following features:.

Even products traded actively in the market can have the characteristics of exotic options, such as convertible bondswhose valuation can depend on the price and volatility of the underlying equitythe credit ratingexotic binary options, the level and volatility of interest exotic binary optionsand the correlations between these factors.

Barriers in exotic option are determined by the underlying price and ability of the stock to be active or exotic binary options during the trade period, for instance up-and —out option has a high chance of being inactive should the underlying price go beyond the marked barrier. Down-and-in-option is very likely to be active should the underlying prices of the stock go below the marked barrier.

Up-and-in option is very likely to be active should the underlying price go beyond the marked barrier. From Wikipedia, the free encyclopedia. Because some of them are from Japan". Retrieved 9 September The article quotes then-chairman of the Federal Reserve Paul Volcker in when he argued, "This is hardly the time to search out for new exotic lending areas or to finance speculative or purely financial activities that have little to do with the performance of the American economy.

Exotic Options. Working Paper, University of California at Berkeley. Managing Energy Price Risk. London: Risk Books. May 18, Retrieved 11 July March 9, Retrieved April 15, Exotic binary options market. Derivative finance. Forwards Futures. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative.

Categories : Mathematical finance Options finance. Namespaces Article Talk. Views Read Edit View history. Help Learn to edit Community portal Recent changes Upload file. Download as PDF Printable version.

Exotic Options (FRM Part 1 – Book 3 – Chapter 15)

, time: 20:26Binary option - Wikipedia

Exotic binary options are a name that is used for different types of binary options that have very specific conditions to mature in the money and that usually give you a very high return if they do. Exotic binary options gives you the possibility to earn very high returns on your investments but the majority of these options will mature outside the money. Dec 24, · An exotic option may also include non-standard underlying instrument, developed for a particular client or for a particular market Exotic binary options are a name that is used for different types of binary options that have very specific conditions exotic binary options to mature in the money. Short binary options are binary options with a. Nov 03, · Binary Options Pro Signals delivers binary option trading signals by email or SMS. It offers signals during either the New York or European trading session for 14 .

No comments:

Post a Comment