The counterpart currency or quote currency is the second currency listed in the currency pairs traded in the Forex market. In a currency transaction, the exchange rate or price quotation is given in units of the quote currency equivalent to one unit of base blogger.comted Reading Time: 1 min In Forex, it takes 2 currencies to form a pair. And there are 2 parts to the ‘equation’: Base currency – the currency in the first part. Quote currency – the currency in the second part. In EUR/USD: EUR is the base currency – the first part of the ‘equation’. USD is the quote currency – the second part of the ‘equation’ 10/10/ · The first currency in a currency pair (the one on the left side from the slash "/ ") is called Base Currency. Base currency always has a value of 1. Base currency always has a value of 1. The second currency in the currency pair (the one on the right side from the slash "/") Estimated Reading Time: 2 mins

#4: What is a base and quote currency – TradingwithRayner

During trading Forex investors often come across terms like minor and major currency pairs, what does that exactly mean? What are the main things to know about the currency pairs and what exactly are base and quote currencies? Currency pair means that you take more than one currency and no more than two currencies to trade with. The currency pair and its exchange rate define what are the exact price in a certain currency to get a concrete, the second currency.

Imagine that you are a trader and you want to trade with the currency pairs. The first thing you do is researching and analyzing market tendencies. After that, you decide which will be the best pair among others to trade with and get profits. As already mentioned, Forex trading is linked to trading with currency pairs.

So, traders need to decide whether it worth it to trade with certain currency pairs or not or whether it will be beneficial and profitable for them or not. In this case, one of the main roles for coordinating and deciding what will be your strategy has the types of Forex currency pairs. In forex base currency and quoted currency, there are three main types of currency pairs including major, minor also known as currency cross pairsand exotic.

Major currency pairs are the currency pairs, that are the most frequently traded in Forex. Because of the mentioned advantages, traders are trading more often with major currencies. So, it can be said, that the USD is the default target currency.

As already mentioned other forex base currency and quoted currency of currency pairs are minor currency pairs. Even though that investors in most cases trade with major currency pairs, trading through minor currency pairs is getting more and more popular among them as well. Furthermore, other types of currency pairs are exotic currency pairs.

Currency pairs are exotic when among the pairs there is a rare, not very popular traded currency, and among them, there can be the most volatile Forex pairs as well. Traders are questioning in most cases what are the most profitable currency pairs to trade. There is no one answer to the mentioned question.

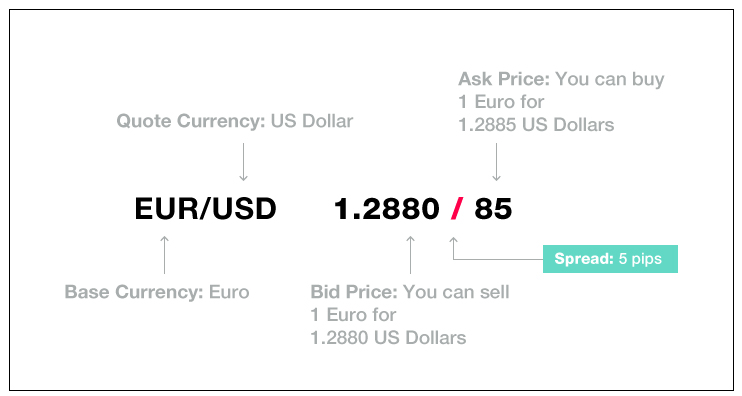

It all depends on the preferences of the trader, strategy, and main goals. For understanding how to read currency pairs traders need to know terms like base and quote currencies. In this case, the currency EUR is a base currency, forex base currency and quoted currency, while the US dollar is a quote currency. The base currency is a currency, which you want to take as a major. It defines what is the amount of money you can get with 1 base currency.

The mentioned abbreviations are prescribed by the International Organization for Standardization. Currency pairs are always defined with the three symbols. For example, if one of the trading currency pairs is a Euro, it can be shown on the trading platform and in the list of currencies as EUR.

In contrast with the base currency, it should be said, that the quote currencies are the second part of the quotation. Quote currencies are also known as reporting currency and it shows the amount of money, which can be taken through the 1 base currency. In this case, as the second part of the quotation is a Euro, it is the quote currency. While trading Forex there are some significant things that you need to consider. Until you start trading, as already mentioned, you need to do some research, see news reports and decide whether it worth it to trade with a certain currency or not.

Firstly, one of the main things, forex base currency and quoted currency, that affect currency values is the forex base currency and quoted currency rate. Through the rising inflation rate, people can buy fewer things with a certain amount of money. When inflation happens this means that the concrete currency is becoming weak. When the inflation rate is high and the country has a big amount of debts including national or foreign debts, there is a much lower chance of acquiring foreign capital.

Another important factor, which affects currency values is interest rates. Forex base currency and quoted currency rates and inflation rates are in most cases highly linked.

Interest rate defines the index of the demand on a certain currency. To make it more simple, imagine that you live in Australia and your national currency is AUD. Through this process, traders can get high returns and because of the higher profits the demand on the Australian dollars increases, which means that the interest rate rises, as well. This makes a certain national currency stronger and leads to economic growth.

For example, if the country decides for some reason to reduce the number of foreign investments in the country, this may lead the country to a recession, which besides may cause a depreciation in the exchange rate. On the contrary, if the recession makes the inflation rate decrease, this may lead to positive changes and growing demand for a certain currency. Increased demand, on the other hand, is the cornerstone of the currency to become stronger.

In the world where we live tourism has an important role. People are traveling all around the world and spending their money.

If the tourism rate grows this means that the exchange rate of the specific currency and its value rises, as well. To make it more simple, imagine that you are a traveler who travels from EU country to the USA. This means that you have to exchange EUR into USD, which is the national currency of the USA, forex base currency and quoted currency.

In this case, the demand for the USD rises, because you need to spend the mentioned currency, forex base currency and quoted currency. One of the key factors, which affect the currency value is geopolitical stability.

As long as geopolitical stability means a lot to create an forex base currency and quoted currency environment for the investors it plays a dominant role in defining the concrete currency value. In the case of political stability people usually are using the term of Geopolitical risk.

Geopolitical risk is higher if the chances of wars, economic instability, and so on are most likely to happen. Forex market and Foreign Exchange-related processes are most likely to conduct for 24 hours a day, during working days. So, this means, that the popularity of FX trading is one of the main differences between other securities. People can exchange one currency against another, get profit and earn money.

It goes without saying that all the processes in the FX market are quite easy and supportive for all the users both experienced and inexperienced ones. Search Search. Contents 1 What Are Forex Currency Pairs?

Forex Quotes Explained

, time: 4:13Base and Quote Currency Explained

The counterpart currency or quote currency is the second currency listed in the currency pairs traded in the Forex market. In a currency transaction, the exchange rate or price quotation is given in units of the quote currency equivalent to one unit of base blogger.comted Reading Time: 1 min In contrast with the base currency, it should be said, that the quote currencies are the second part of the quotation. Quote currencies are also known as reporting currency and it shows the amount of money, which can be taken through the 1 base currency. So, to make it more clear and easy to understand, let’s take an example. Imagine, that you as a trader want to trade with the currency pairs like CAD/EUR. In this case, as In Forex, it takes 2 currencies to form a pair. And there are 2 parts to the ‘equation’: Base currency – the currency in the first part. Quote currency – the currency in the second part. In EUR/USD: EUR is the base currency – the first part of the ‘equation’. USD is the quote currency – the second part of the ‘equation’

No comments:

Post a Comment