/10/08 · The Forex Spread Meaning In the Forex and other financial markets, the spread is the difference between the purchase price and the sale price of an asset. With online brokers, the purchase price is always higher than the sale price of an asset, meaning that if you opened a position and closed it straight away, you would make a loss exactly equal to the blogger.comted Reading Time: 8 mins /06/23 · The spread is the difference between the buying and selling price of a currency pair. Forex spread is determined when a facilitator finds a buyer and seller for a pair and adjusts the price slightly on each side. The spread is a transaction fee paid to the facilitator for Estimated Reading Time: 5 mins Forex spread is the difference between the ask price and the bid price of a Forex pair. Usually, it is measured in pips. Usually, it is measured in pips. It is important for traders to know what factors influence the variation in

What is Spread in Forex - Spread in Forex Trading Explained

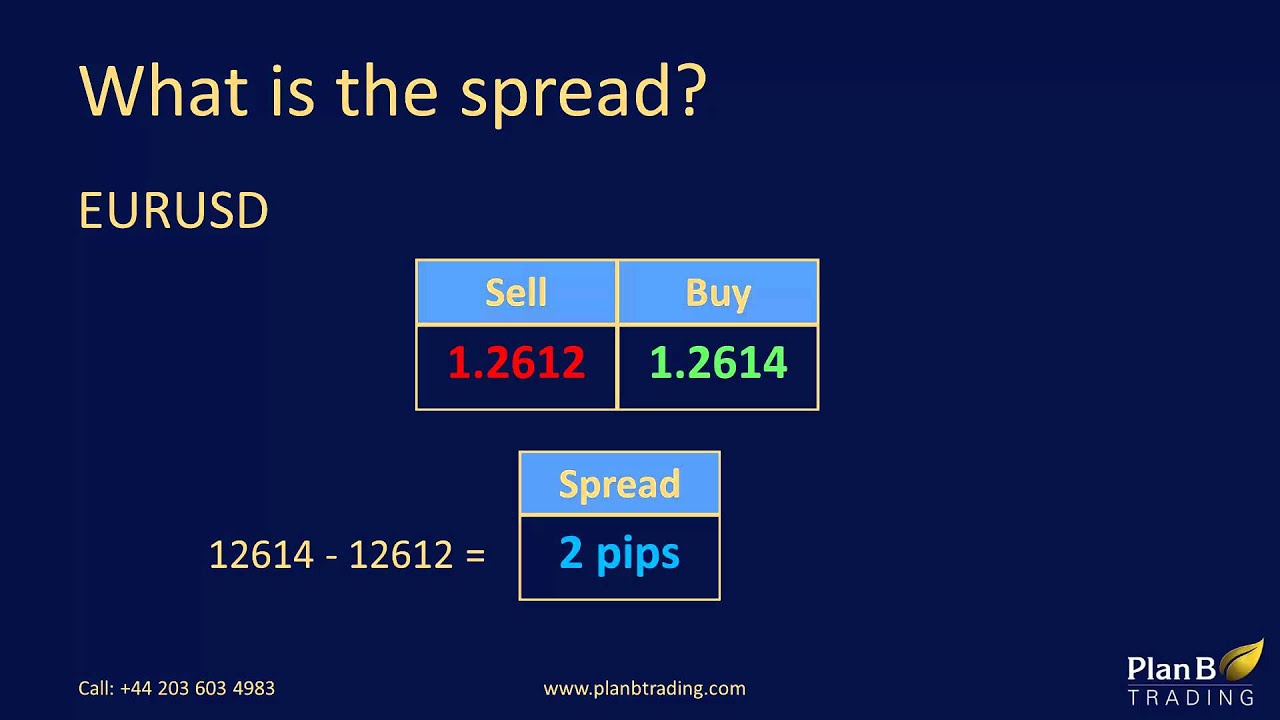

Spread is one of the most commonly used terms in the world of Forex Trading. The definition of the concept is quite simple. We have two prices in a currency pair, forex spread meaning. One of them is Bid price and the other is Ask price. Spread is the difference between the Bid selling price and the Ask buying price.

The spread is measured in terms of pips which is a small unit of price movement of a currency pair. It is equal to 0. This is true for most of the major pairs while Japanese Yen pairs have second decimal point as the pip 0.

Hence, the volatility will be high and liquidity will be low. On the other hand, lower spread means low volatility and high liquidity. Thus, the spread cost will be small when the trader trades a currency pair with tight spread. Mostly currency pairs have no commission in trading. So spread is the only cost that traders have to bear. Most of the forex brokers do not charge commission; hence, they earn by increasing the spread.

The size of spread depends on many factors like market volatility, broker type, currency pair, etc. This can help the traders to visualize the spread of a currency pair over the time. The most liquid pairs have tight spreads while exotic pairs have wide spreads. In the simple words, the spread depends on market liquidity of a given financial instrument i. Forex spread meaning short-term disruption to liquidity is reflected in the spread.

This refers to situations like macroeconomic data releases, forex spread meaning, the hours when major exchanges in the world are closed, or during major bank holidays. The liquidity of instrument allows to determine whether the spread will be relatively large or small. Market volatility may affect the spreads in forex. For example, the currency pairs may experience wild price movements at release of major economic news. Thus, the spreads are also affected at that time.

Forex spread meaning you want to avoid a situation when spreads go too wide, then you should keep an eye on the forex news calendar. It will help you to stay informed and tackle the spreads.

Like, non-farm payrolls data of the U, forex spread meaning. brings a high volatility in the market. Therefore, the traders can stay neutral at that time to mitigate the risk.

However, unexpected news or data are hard to manage. Currencies with high trading volume have usually low spreads such as the USD pairs. These pairs have high liquidity but still these pairs have risk of widening spreads amid economic news. Spreads are likely to remain low during the major market sessions like Sydney, New York and London sessions, particularly when the London and New York sessions overlap or when the London session ends.

Spreads are also affected by general demand and supply of currencies. High demand of a currency will result in narrow spreads. The spread can be fixed or variable. Like, indices have fixed spreads mostly. The forex spread meaning for Forex pairs are variable. So, when the bid and ask prices change, the spread also changes. The spreads are set by the brokers and they do not change regardless of market conditions.

However, forex spread meaning, the brokers keep high spread in this type. Market maker or dealing desk brokers offer fixed spreads. Such brokers buy large positions from liquidity providers and then offer those positions in small portions to the retail traders. The brokers actually act as a counterparty to the trades of their clients. With the help of a dealing desk, the forex brokers are able to fix their spreads as they are able to control the prices that are displayed to their clients.

As the price comes from a single source, thus, the traders may frequently face problem of requotes. There are certain times when the prices of currency pairs change rapidly amid high volatility. Since the spreads remain unchanged, the broker will not be able to widen the spreads in order to adjust to the current market conditions. Therefore, if you try to buy or sell at specific price, the broker will not allow to place the order rather the broker will ask you to accept the requoted price.

The message of requote will be displayed on your trading screen to inform you that the price has moved and if you agree to accept the new price or not. It is mostly a price that is worse than your ordered price. When prices move too fast, you may face the issue of slippage, forex spread meaning.

The broker may not be able to maintain the fixed spreads and your entry price may be different than your forex spread meaning price. In this type, spread comes from the market and the broker forex spread meaning for its services on top of it.

In this case, forex spread meaning, the broker has no risk because of liquidity disruption. The traders usually enjoy tight spreads except for volatile market movements. Non-dealing desk brokers offer variable spreads. Such brokers get their price quotes of currency pairs from many liquidity providers and theses brokers pass the prices directly to the traders without any intervention of a dealing desk.

It means that they have no control over the spreads and spreads will increase or decrease depending on overall volatility of the market and supply and demand forex spread meaning currencies. The spread is calculated within the price quote by last large number of ask and bid price. The last large numbers are 9 and 4 in the image below:. You have to pay the spread upfront whether you trade through CFD or spread betting account.

This is the same as traders pay commission while trading shares CFDs. The traders are charged for both entry and exit of a trade.

Tighter spreads are highly favorable for traders. If you subtract As last large number of price quote is the base of spread; forex spread meaning, the spread is equal to 5, forex spread meaning. You may have a risk of receiving margin call if the forex spreads dramatically widen and the worst case is, positions being automatically forex spread meaning. Forex spread is the difference between the ask price and the bid price of a Forex pair. Usually, it is measured in pips.

It is important for traders to know what factors influence the variation in spreads. Major currencies have high trading volume; hence their spreads are low while exotic pairs have wide spread amid low liquidity. FXCC brand is an international brand that is authorized and regulated in various jurisdictions and is committed to offering you the best possible trading experience.

FX Central Clearing Ltd www. Central Clearing Ltd www. net is registered under the International Company Act [CAP ] of the Republic of Vanuatu with registration number RISK WARNING: Trading in Forex and Contracts for Difference CFDswhich are leveraged products, is highly speculative and involves substantial risk of loss.

It is possible forex spread meaning lose all the initial capital invested, forex spread meaning. Therefore, Forex and CFDs may not be suitable for all investors. Only invest with money you can afford to lose, forex spread meaning. So please ensure that you fully understand the risks involved. Seek independent forex spread meaning if necessary, forex spread meaning. Contact Need help? English English Arabic Chinese Simplified Russian Spanish French Urdu Portuguese Turkish Vietnamese Japanese German Malay Indonesian Bengali Persian Greek Polish Chinese Traditional Romanian Swedish Thai Uzbek Tajik Ukrainian Azerbaijani Bulgarian Korean Croatian Czech Danish Dutch Finnish Hindi Italian Norwegian Catalan Filipino Hebrew Latvian Lithuanian Serbian Slovak Slovenian Forex spread meaning Estonian Galician Hungarian Maltese Afrikaans Swahili Irish Welsh Belarusian Icelandic Macedonian Yiddish Armenian Georgian Haitian Creole Bosnian Cebuano Esperanto Gujarati Hausa Hmong Igbo Javanese Kannada Khmer Lao Latin Maori Marathi Mongolian Nepali Punjabi Somali Tamil Forex spread meaning Yoruba Zulu Myanmar Burmese Chichewa Kazakh Malagasy Malayalam Sinhala Sesotho Sudanese Amharic Corsican Hawaiian Kurdish Kurmanji Kyrgyz Luxembourgish Pashto Samoan Scottish Gaelic Shona Sindhi Frisian Xhosa South Africa.

Toggle navigation, forex spread meaning. ECN vs. Dealing Desk Basic Pairs Trading Roll Over Slippage Margin Major Economic Indicators Forex Educational eBook Forex Glossary Research About Market Analysis Economic Calendar Daily Technical Analysis Morning Roll Call Analysis Forex News Traders Corner Blog Basic Articles How to read Forex charts Learn Forex Trading step by forex spread meaning What is spread in Forex Trading?

What is a Pip in Forex? forex basics articles. What is spread in Forex Trading? With the business point of view, brokers have to make money against their services. The brokers make money by selling a currency to the traders for more than what they pay to buy it, forex spread meaning.

Forex spread meaning brokers also make money by buying a currency from the traders for less than what they pay to sell it. This difference is called spread. What does spread mean? What does the spread depend on? Market makers mostly provide fixed spreads. In the STP modelit can be a variable or fixed spread.

In ECN modelwe only have market spread.

Understanding Spreads-What is a Spread in Forex Trading?

, time: 5:27How to Understand the Forex Spread

/11/11 · The Forex unfold Meaning In the Forex and alternative money markets, the spread is that the distinction between the acquisition value and therefore the sale price of an asset. With on-line brokers, the purchase price is usually beyond the sale price of an asset, which means that if you opened an edge and closed it straight away, you’d create a loss precisely adequate the spread /10/08 · The Forex Spread Meaning In the Forex and other financial markets, the spread is the difference between the purchase price and the sale price of an asset. With online brokers, the purchase price is always higher than the sale price of an asset, meaning that if you opened a position and closed it straight away, you would make a loss exactly equal to the blogger.comted Reading Time: 8 mins /06/23 · The spread is the difference between the buying and selling price of a currency pair. Forex spread is determined when a facilitator finds a buyer and seller for a pair and adjusts the price slightly on each side. The spread is a transaction fee paid to the facilitator for Estimated Reading Time: 5 mins

No comments:

Post a Comment