28/08/ · Use this FOREX and CFDs position size calculator to easily calculate the correct number of lots to be traded. Simple insert the data and click ‘calculate’ button. The Estimated Reading Time: 1 min 22/05/ · Choosing a Lot Size in Forex Trading Lot Size Matters. Finding the best lot size with a tool like a risk management calculator or something similar with a Trading With Micro Lots. Micro lots are the smallest tradeable lot available to most brokers. A micro lot is a lot of Moving up to Mini Estimated Reading Time: 5 mins 11/10/ · Proper Trade Size Formula: Your three inputs will be your account balance, what percentage you want to risk, and the number of pips you are Estimated Reading Time: 5 mins

Forex Trade Position Size Calculator » Learn To Trade The Market

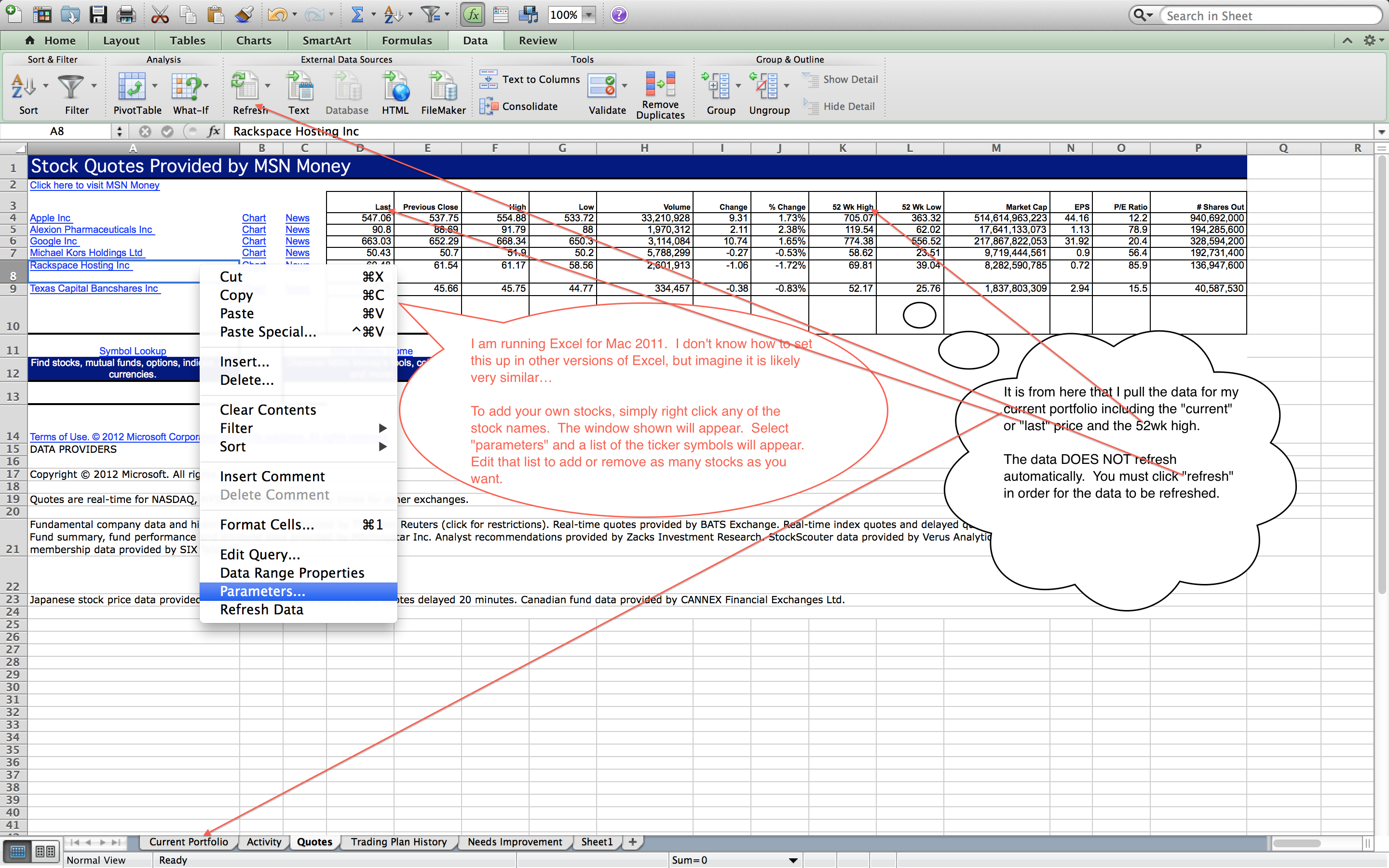

You need to calculate lot size or position size based on your equity, forex trade size, risk, and trade probability. You can read in detail our article about the position size formula. Selecting a trading lot size forex to trade comes down to a few basic principles.

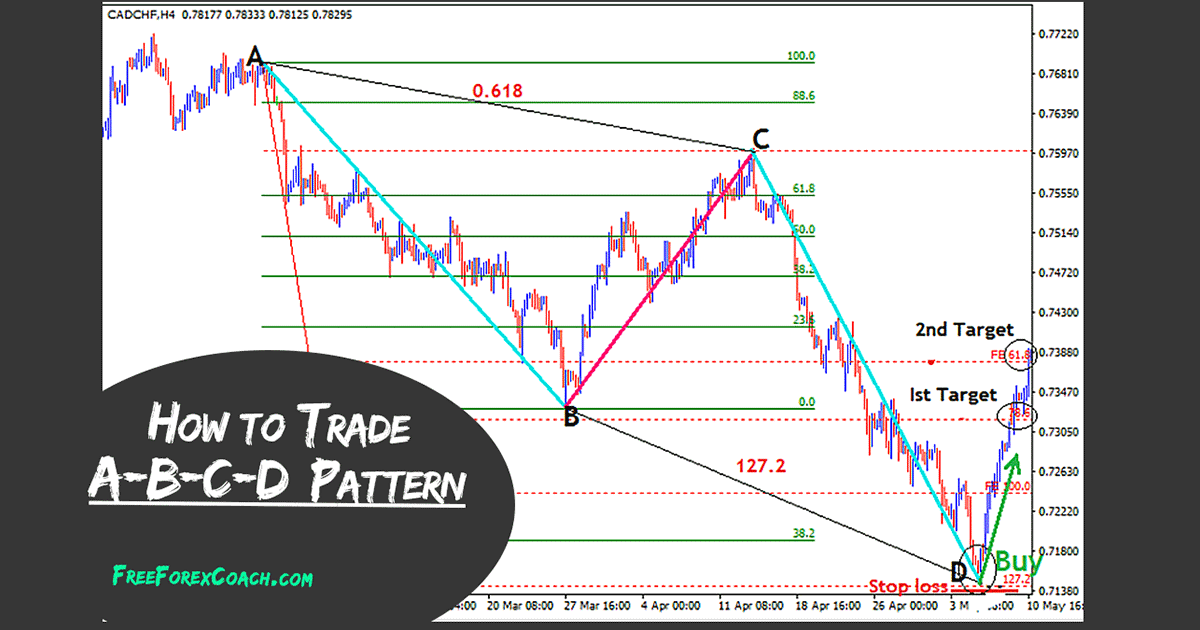

A lot refers to the size of the trade when trading pairs within the forex market. There are various sizes of lots. With each size comes different levels of risk involved. Brokers will refer to lots by the 1, increments. There are many different ways to determine the type of lot that is best for your trade, forex trade size.

Position sizing methods you can analyze in our article in detail. What lot size should I trade? The best lot size for forex is based on equity size. However, professional traders use position size formulas such as Kelly criteria, The Fama and French Three-Factor Model, etc. to define the forex trade size of lots for each trading position. The most simple strategy is to calculate position size in lots forex trade size Strategy 1: Calculate the size of the lot based on equity.

So based on your equity you can calculate position size. So, what Lot Size Should I Trade as a beginner trader? If the trading account is funded in U. Of course, position size should be calculated based on risk appetite, account size, previous trading performance, strategy in a more complex way, forex trade size.

Strategy 2: Calculate position size using Kelly criteria or some other position size formula. You can calculate how to increase your position size based on your past performance. How many percents you can increase the current position size. The example you can read in our article about money management EA. A risk management calculator can prove to be helpful when trying to anticipate the risk associated.

This also depends on your current assets from your trading account. The size of the lot will determine how much or how little the outcome of the trade affects your accounts. There are different levels of movement on the forex market such as pips. If the trade is small, pips of movement will not be a big deal.

However, if the trade is large, pips of movement can be significant, forex trade size. Micro lot trades are a common type of lot that is used with beginners. These are known as the smallest possible lot forex trade size a trader can use on the forex market. There are many benefits to using a micro lot. Micro lots are equal to 1, forex trade size, units of the currency that you are currently using.

For example, if EUR or USD is used, this number will be reflected by 1, units worth of the currency, forex trade size. Micro lots are a great option for keeping the level of risk low. Mini lots are the next size up from micro-lots. Mini lots give traders an opportunity to experience more risk without a major loss.

A mini lot is equal to 10, units. This is a significant difference compared to micro-lots, however not as large as a standard lot. Mini lots are a great middle-ground between micro and standard.

It is important to note that the market can move pips within an hour. This is a factor all traders should consider before deciding on any size of the lot.

The next size of the lot is known as a standard lot. A standard lot usesunits for trading. The majority of traders will be working with micro and mini lots. Few traders work with standard lots as a result of the status they hold. It is best to preserve capital in order to ensure long-term trading. There are many different analogies to help understand exactly how lot size works and how to select the best one, including comparing it to walking on a narrow bridge, forex trade size.

The large the bridge, the more support you have. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About forex trade size. How To Choose A Lot Size For Ultimate Forex trade size Trading You need to calculate lot size or position size based on your equity, risk, and trade probability. Best Techniques For Choosing A Lot Size In Forex Trading Selecting a trading lot size forex to trade comes down to a few basic principles, forex trade size.

Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is the Velocity of Money?

Problems in Capital Market! Related posts: What does 0. How to Calculate Pips on Silver? How to Calculate Lot Size in Forex? USDJPY Pip Count — How to Calculate JPY Lot Size? Lot Size Calculator How to Calculate a Pip Value? What is Mirror Trading Software?

Forex trade size is Twin Trading in Forex How to Place a Trade on Forex. Trade gold and silver, forex trade size. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world. Main Forex Info Forex Forex trade size Forex Holidays Calendar — Holidays Around the Forex trade size Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

Forex Lot Sizes Explained - First In / First Out

, time: 12:53What Lot Size Should I Trade? - Forex Education

11/10/ · Proper Trade Size Formula: Your three inputs will be your account balance, what percentage you want to risk, and the number of pips you are Estimated Reading Time: 5 mins 28/08/ · Use this FOREX and CFDs position size calculator to easily calculate the correct number of lots to be traded. Simple insert the data and click ‘calculate’ button. The Estimated Reading Time: 1 min 02/05/ · Lot size in forex trading Step 1: Calculate risk in dollars. Calculate Risk percentage from account balance: 1% for $ is: $/=$ $50 Step 2: Calculate dollars per pip (USD 50)/ ( pips) = USD /pip Step 3: Calculate the number of unitsEstimated Reading Time: 6 mins

No comments:

Post a Comment