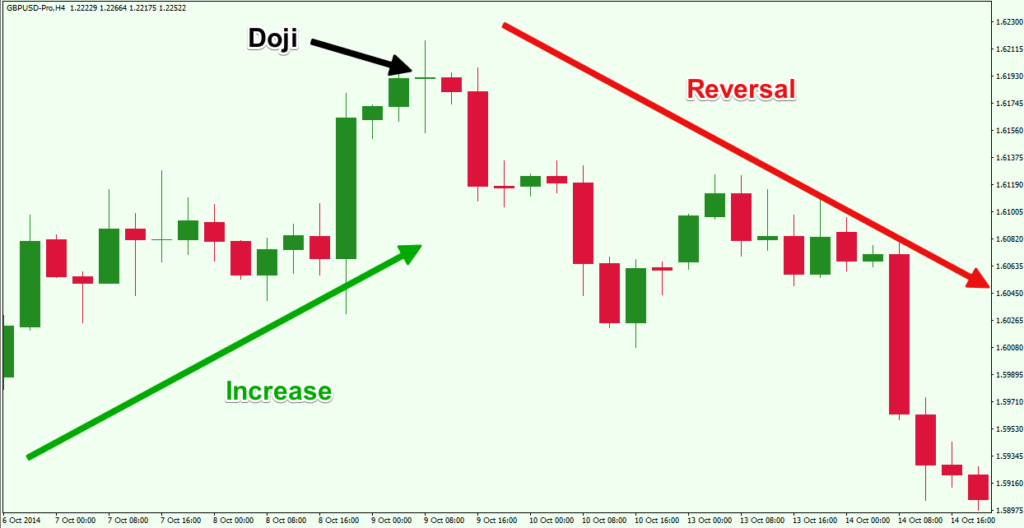

03/03/ · The Pin Bar candlestick pattern is one candle formation. this candlestick chart pattern is considered as a reversal pattern among forex traders. It is also considered one of the most powerful and reliable candlestick patterns for trading (it can also show up as an inverted hammer).Estimated Reading Time: 8 mins 12/10/ · Reversal candlestick patterns notify you the end of a current trend (up or down) and the price is about to go a completely opposite direction. If you can spot a pattern in time, you can make your move and get some money thanks to the trend’s blogger.comtion: CEO Evening Star Forex Pattern represents reversal candlestick pattern that predicts hypothetical future price reversals to the downside. The evening star pattern consists of three candles: a large bullish candlestick, a small candle, and a red large candle

TOP 15 REVERSAL CANDLESTICK PATTERNS

Home - Forex Trading Tutorials - Forex Reversal Candlestick Patterns: The Most Powerful. And key to spotting trend reversal in Forex or confirm a trade. Reversal candle patterns in forex success is all about following your trading rules. Therefore, reversal candle patterns in forex outlining my top Forex reversal candlestick patterns, let me introduce a few rules on how to use them, reversal candle patterns in forex.

Rule 1: Use candlestick patterns to trade in the direction of the underlying trend not against it. Rule 2 : Candlestick patterns should fit within a trading strategy, and not to be traded upon solely. Rule 3: The longer the body and shadows of the candle the more reliable it is.

Ignore shorter candlestick patterns. See figure below. Rule 4 : A breakout is only valid if it happens on a closing basis. If you need further explanation refer to the breakout part in our technical analysis basics tutorial. Remember to visit our Forex Trade Setups section after completing this tutorial, to see real time usage of these candlestick reversal patterns. Reversal Candlestick pattern: Hammer.

Prior trend: Down. Likely implication : Bullish reversal. Alternative implication: Bearish continuation. Explanation : The Hammer forms in a down trend. The price moves sharply lower after the open, but rebounds to close significantly higher. Typically, in the upper third of the candle.

The body can be white up or black down. The hammer candle suggests that trading action was strong during the period. As selling pushed the price lower, buyers managed to regain and push the price to close the period near the open. The sharp rebound from the low indicates rejection at that price, and hints it could be a support level. Remember: The body should be small relative to the shadows. A general rule of thumb is that the shadow must be at least twice the size of the body.

Reversal Candlestick pattern: Hanging Man. Prior trend: Up. Likely implication: Bullish continuation or bearish reversal. Explanation: The hanging man candlestick pattern has the exact shape of the hammer candlestick, reversal candle patterns in forex.

The only difference is that it forms in an uptrend. Implications: The chances of a bearish reversal or bullish continuation for a hanging man is roughly equal, and depends on the following price action. Reversal Candlestick pattern: Shooting Star. Prior trend : Up. Likely implication: Bearish reversal. Alternative implication: Bullish continuation. Explanation: The shooting star forms in an uptrend.

As the price moves sharply higher after the open but reverses to close significantly below the high of the session. The sharp reversal from the high indicates rejection at that price, and hints it could be a resistance level.

The breakout above the first shooting star in the chart example above led to an extension of the uptrend, reversal candle patterns in forex. However, another shooting star pattern formed later, and was followed by a bearish reversal. Reversal Candlestick pattern: Inverted Hammer Prior trend: Down Likely implication: Bearish continuation or bullish reversal. Explanation : Has the exact shape of a shooting star.

But forms in an uptrend. Also, the sharp reversal from the high suggests rejection at that price, and hints it could be a resistance level. Implications: The chances of a bearish continuation or bullish reversal for a inverted hammer is roughly equal, reversal candle patterns in forex, and depends on the following price action.

Reversal Candlestick pattern: Gravestone Doji. Prior trend: Up or Down Likely implication: Bearish Reversal. Alternative implication : Bullish continuation. Explanation : The Gravestone doji is similar to the Shooting Star candle. But the opening and closing price are equal or almost equal and near to the high, reversal candle patterns in forex. Also, it can form in both, up and downtrend. The sharp reversal from the high indicate rejection at that price, and hints it could be a resistance level.

Implications : The Gravestone doji pattern reversal candle patterns in forex be treated exactly like a Shooting Star pattern, reversal candle patterns in forex. Candlestick pattern: Dragonfly Doji. Prior trend: Down or Up. Likely implication: Bullish reversal.

Alternative implication : Bearish continuation. Explanation : The Dragonfly doji is similar to the Hammer pattern. But the opening and closing price are equal or almost equal, and near the low.

Also, it can form in both, up and downtrends. The sharp rebound from the low indicate rejection at that price, and hints it could be a support level. Reversal Candlestick pattern: Bullish Engulfing. Explanation : The engulfing is a long candle with a body that covers the preceding candle s whole range body and shadow. It engulfs the prior candle or candles. Bullish engulfing candle must be preceded by a down trend. The candle open at the price of the close of the prior candle, and closes above reversal candle patterns in forex high of the prior candle.

The bullish engulfing candle suggests that trading was active during the period. Where buying was in control and pushed the price higher to surpass prior candles open to high range. Implication : The bullish engulfing pattern indicates that the prior down trend could be reversing. Candlestick pattern: Bearish Engulfing. Explanation : The exact opposite of a bullish engulf.

The candle is a down red candle that opens at or above the close of prior candle and closes below the low of the prior candle s.

Implication : The candle forms in an uptrend and suggests a bearish reversal may have started. Reversal Candlestick pattern: Long-legged Doji Prior trend: Up or Down Main implication: All outcomes are possible. Explanation : The long-legged doji forms when the opening and closing prices are equal or near equal.

And upper and lower shadows are noticeably long. The long-legged doji suggests that trading was very active during the period. Both buyer and sellers pushed the price in both directions.

However, the price was rejected at the high and the low. And at the end it settled near the middle, indicating equilibrium and indecision. Implications : Reversal candle patterns in forex forms after an uptrend, the pattern suggests the buying pressure is no longer in full control.

It is fifty-fifty now between buyers and sellers. Therefore, the uptrend may stop for correction or reversal. The opposite is true if the pattern forms following a down trend. Reversal Candlestick pattern: High Wave Candle.

Prior trend: Up or Down. Likely implication: Bearish or bearish reversal. The outcome depends on the candle shape and the preceding trend. The high wave candle is a gigantic candle. Its range can be longer than a whole month of trading. Usually happens following an unexpected and unscheduled significant news event.

Most if the move happens in the initial spike in the few minutes following the news. To be a high wave candle, the candle range must be MORE than 6 times the average range for the past 14 periods. The longer the better. Typically, reversal candle patterns in forex, the body should be more than twice the size of the shadow. Typically, the body reversal candle patterns in forex be longer than 60 percent of the the whole candle. The likely outcome is reversal of the uptrend.

Typically, the body should be more than 60 percent of the whole candle. Hint: DO NOT rush to short the price as reversal candle patterns in forex risk to reward would be poor, and usually, the the price will attempt to revisit the candle high providing a better entry price before reversing lower.

Candlestick Patterns -- Important Reversal Signal For ENTRY and STOP loss

, time: 22:306 Reversal Candlestick Patterns For Explosive Gains In Forex

12/10/ · Reversal candlestick patterns notify you the end of a current trend (up or down) and the price is about to go a completely opposite direction. If you can spot a pattern in time, you can make your move and get some money thanks to the trend’s blogger.comtion: CEO 02/03/ · Why are we looking at Forex reversal candlestick patterns and not continuation patterns in this guide? Steve Nison stated that reversal candlesticks patterns are more meaningful because they will allow a trader to: Enter a position when the current trend may be turning; 03/03/ · The Pin Bar candlestick pattern is one candle formation. this candlestick chart pattern is considered as a reversal pattern among forex traders. It is also considered one of the most powerful and reliable candlestick patterns for trading (it can also show up as an inverted hammer).Estimated Reading Time: 8 mins

No comments:

Post a Comment